Great Businesses, Solving Global Challenges

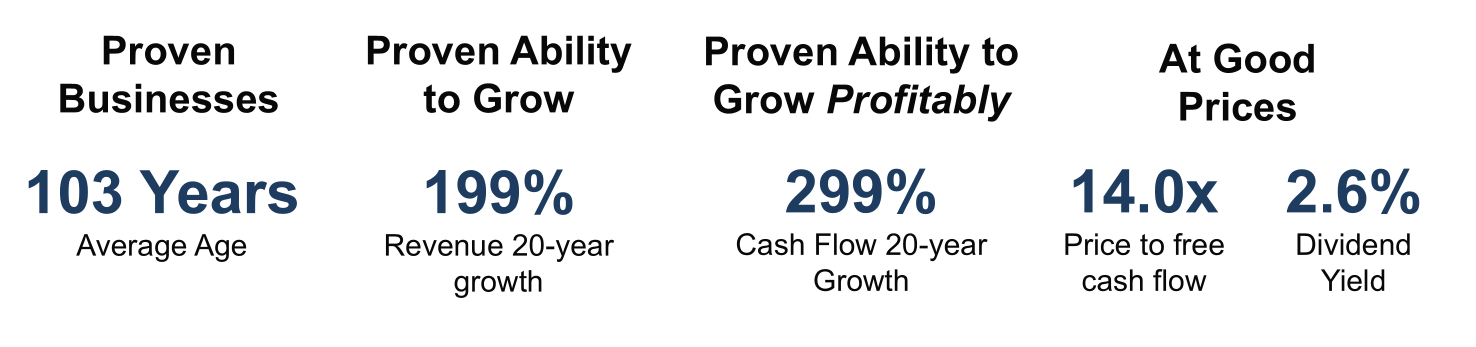

We take a unique approach by combining great businesses that have proven abilities to grow and compound over time with sustainability.

The worlds largest businesses have the greatest opportunities to make a big impact. The companies that recognize this, we believe are the best positioned to succeed in the future.

Proprietary Fact-Based Approach to Sustainability

We conduct a thorough analysis on each company to ensure they are leading in improving their industry or creating the products that we need to make the world more sustainable. We look at the track records of companies and the ambition of the business to improve the world we live in.

Notes: Holdings in the Pool as of May 31, 2025. Values as of April 8, 2025. Forward price to free cash flow is calculated using forward twelve months consensus estimates and uses price to earnings for companies where cash flow is not relevant, which includes insurance companies, banks and utilities. Dividend yield is a portfolio weighted average for holdings in the Pool. 20-year growth is calculated using most recent last twelve months in local currency and is calculated using cash from operations for all companies except banks, utilities and insurance which uses earnings. Dividend yield is weighted average dividend. Source: S&P Capital IQ, Bloomberg, Value Partners Investments.