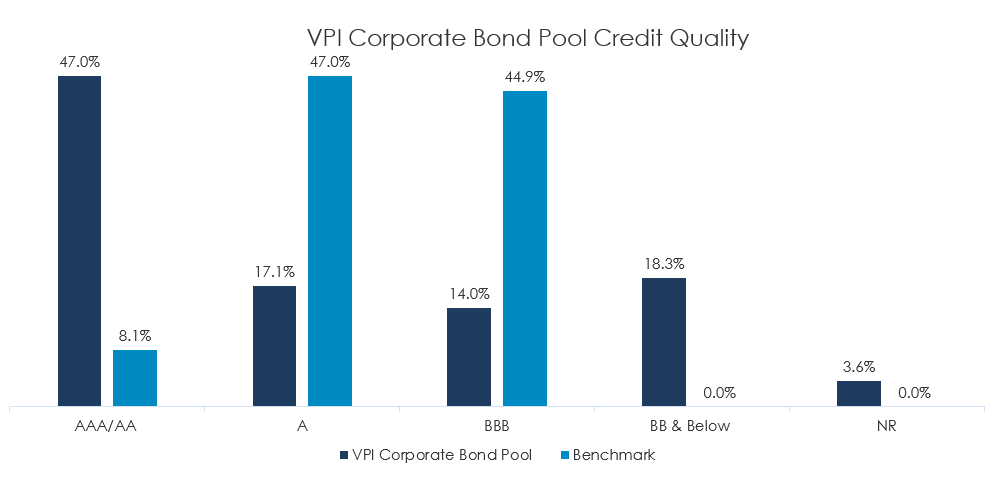

A proprietary bond rating system.

The portfolio manager, Canso, has a large team of credit professionals who focus on internal credit research. Canso does not rely on external research or credit rating agencies. Extensive research is conducted on issuers before making an investment and research is continually updated on an ongoing basis for each issue in the portfolio. The portfolio manager keeps extensive files on all issues, whether they participate in them or not. As new information becomes available it allows the portfolio manager to move quickly if an opportunity presents itself.

No limits on credit quality.

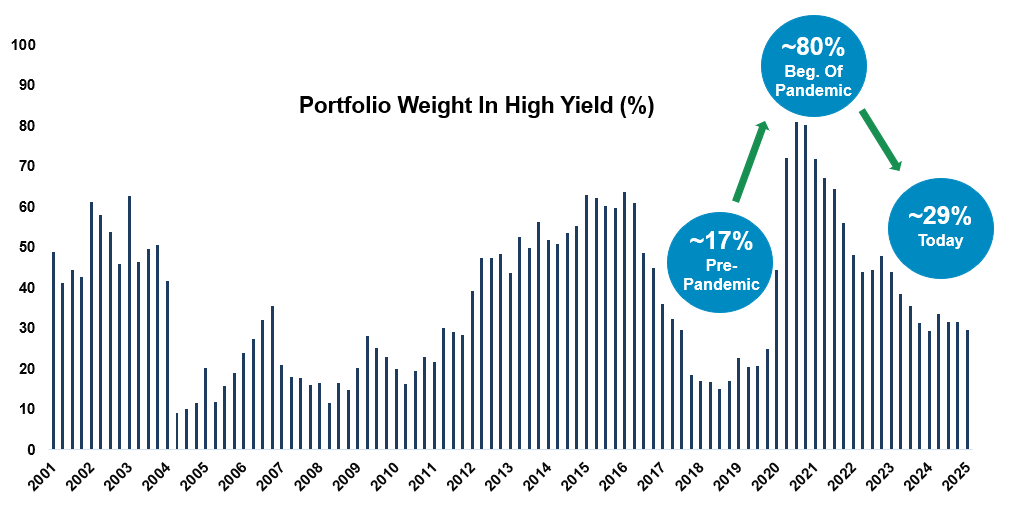

The VPI Corporate Bond pool has the ability to shift its weight in high yield depending on the current market environment. Recently, we have been migrating the portfolio away from high yield into shorter duration, much higher quality instruments.

Portfolio Weight in High Yield for the Canso Corporate Value Strategy from 2001 to November 2013, Bond Component of VPI Income Pool from December 2013 to June 2020, VPI Corporate Bond Pool from July 2020 to March 2025. Both VPI Corporate Bond Pool and the Bond Component of VPI Income Pool have been managed using the same investment methodology as Canso Corporate Value Strategy. Source: Canso Investment Counsel Ltd.

Migrating to Quality.

As of March 31, 2025. Source: Canso Investment Counsel Ltd.